Sunday, December 26, 2010

Wednesday, November 24, 2010

Qualms with QE... or not.

Wednesday, September 8, 2010

Saturday, May 1, 2010

GDP up 3.2% in Q1

I've said this before and I'll say it again, but at some point, family households will have to come to terms with their situations and begin to repair their balance sheets. At this time one would expect the savings rate to go up, and consumption to go down but I'm definitely leaving the door open to other possibilities. I wouldn't short U.S. market indices, and for now I don't think I'd short U.S. treasuries either. It's still the safest investment around. The Greek mess helped bring down the yield on 10-y to 3.67 yesterday, down from about 3.9 two weeks ago. It's easy to worry about America's debt and possible inflation, but don't lose site of this trend: When a negative exogenous economic shock happens somewhere in the world, U.S. t-bills benefit. It's the same flight to quality we've seen for decades now, and I don't expect it to end any time soon.

I Like Writing, Think I'll Keep Doing It.

For me, the article was cool because it brought some of these ultra-high-powered individuals down to earth and showed that they are, for the most part, real people. More than anything, it kind of made me reflect on my life and the people I associate with. I definitely enjoy the college life and enjoy my friends, but most of them aren't exactly "type-A" personalities. The article depicted a dynamic environment in which a congregation of highly motivated and intelligent individuals work together tirelessly to achieve a greater end. At some point, I want to be in such an environment, and I want to know such people. Hopefully that doesn't mean I have to go into politics... I think a career in finance should suffice. Any employers out there?! Read me! Hire me! Please lord! I'm begging to come in and work really hard! I just want to put my knowledge to good use!

Wow, that looks a bit desperate, nobody reads this... Maybe I'll start linking things I post about economics to my facebook page for all of my non-interested friends to read... Ha ha.

Saturday, March 6, 2010

True Religion is a BUY for Svigals and Tall Firs Portfolios

Unemployment Report

It shows about a four month lag between temp hiring and actual employment growth. Judging from the activity we've seen in temporary labor, we would expect to see some positive jobs news in the near future. The logic behind this is simple, following a recession firms will increases hours of current employees and hire temporary workers before making any permanent changes. It's still difficult to tell what's going to happen, but I would say that seeing growth in temporary labor is definitely better than not seeing growth. The economy is still in a depressed state. 9.7% unemployment is way too high. State governments will not be able to maintain public services if they're losing that kind of revenue and the federal government will not be able to maintain unemployment benefits to that number of people without further increases in the deficit.

It shows about a four month lag between temp hiring and actual employment growth. Judging from the activity we've seen in temporary labor, we would expect to see some positive jobs news in the near future. The logic behind this is simple, following a recession firms will increases hours of current employees and hire temporary workers before making any permanent changes. It's still difficult to tell what's going to happen, but I would say that seeing growth in temporary labor is definitely better than not seeing growth. The economy is still in a depressed state. 9.7% unemployment is way too high. State governments will not be able to maintain public services if they're losing that kind of revenue and the federal government will not be able to maintain unemployment benefits to that number of people without further increases in the deficit.In general, this report didn't give me a lot of reason to be optimistic. All the pundits seem to be declaring we've "reached bottom," which is great and all, but they were saying the same thing 6 months ago. The most significant part of the stimulus package is behind us, fed emergency programs are unwinding, and the economy is going to have to stand on its own two feet. It just seems like broadly, there are a lot more headwinds out there than tailwinds, that is, more factors are putting downward pressure on the economy than upward pressure.

Friday, March 5, 2010

Fed Watch: Deflation

I don't understand what's going on here. How exactly do we go about reconciling large increases in PPI and import prices with the .1% decrease in core CPI? Are consumers simply unable to hold the burden of increased input prices? And if this is the case, why on earth are producers, specifically in the manufacturing sector, making large investments in new capital and spending on labor? (OK yes its temp labor for the most part but still.) Basically, why the ramp up in production without significant signs of returning demand? I'm not following.

I get the "inventory bounce" argument. I see the connection between "slack" in the broader economy leading to deflationary pressures. So what's with the input price increases? That's the part I don't understand. The only way prices on the producer side can be increasing, is if there is demand for such inputs. If there's demand for the inputs, producers must see consumer side demand out there somewhere. I guess I'm just not seeing it. I agree that the fed should probably be more concerned about deflation, especially considering the events we've seen in Japan, coupled with the fact that deflation can lead to the whole "debt-deflation" death spiral situation. But despite this, manufacturers are going all Jean Baptiste Say on me. I thought we were past this theory in like 1860, why is it still around? It's the old saying "if you build it, they will come," I'm just not sure from where they'll be coming considering the economic environment for the average consumer.

Thursday, March 4, 2010

True Religion Apparel, Inc.

I built a revenue model for the company using a lot of the techniques we've learned in class. It was cool to take my basic knowledge of econometrics/forecasting and combine it with my basic knowledge of equity valuation.

I haven't blogged much this week, and that report is a pretty big reason as to why. If you missed it the first time, here's another link to the same thing.

Friday, February 26, 2010

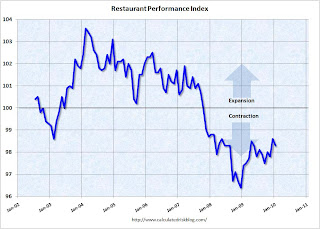

A New Metric I Didn't Know Existed!

We ended up voting hold on the stock for a variety of reasons. I voted hold because I've eaten there, it's not that good, and it was only undervalued by roughly 8%, which can almost be taken out by transaction costs alone. There are a few errors in the DCF, but for the most part a well done and thorough report.

Weekly Initial Unemployment Claims Up

GDP revised up to 5.9%

The headlining number looks pretty good, but I posted before, as did many other bloggers, about most of the change being due to private inventories, while core GDP resulting from increased demand was only up 2.2%. In that sense, this revised report isn't good, as GDP growth due to increased demand was revised down to 1.9% from that 2.2% level.

PCE and Residential investment were both revised down. The picture kind of comes together like this. Core CPI was down, corresponding to the low PCE and Residentiall investment growth, and PPI excluding energy was up, which corresponds to the upward revision of change in private inventories. At the beginning of recoveries, we generally see a lot of "growth" because of this inventory factor, as managers generally overshoot the downtrend. So when market conditions improve, you see a quick jump in inventory to meet the theoretical demand... Trouble is, there's still not much demand. That's why we haven't seen much growth in employment in manufacturing or anything else, and why we've seen solid increases in temporary workers and labor productivity.

Tax Credits and Demand

"The Cash for Clunkers program was effective on July 1, 2009, but didn't really start until near the end of July. The program was expanded in early August, and ended on August 24th.Check out the graph below to see the corresponding effects

The First Time Home Buyer tax credit was passed in February with an initial deadline to close on the home by November 30, 2009. The home buyer tax credit was extended and expanded at the end of October, and now buyers must sign a contract by April 30, 2010, and close by June 30, 2010."

.

You can see the bumps in home sales and vehicles due to the tax credits, and the strong declines after they expire. The housing credit has been less effective this time around because demand was pulled forward, but expect to see better existing home sales numbers around May or so. They'll likely be right at the expiration of the new tax credit, when those sales finally close.

And while on the subject of tax credits, a 6.5% tax credit to employers who hire passed the senate recently. You can expect to see similar effects, though probably not in quite the same manner, as early estimates have the new credit creating roughly 240,000 new jobs. It sounds like a nice number, but it's not going to get us anywhere near where we need to be with regards to reaching potential output.

New Home Sales

"January is a difficult month for the housing sector, made difficult this year by still soft prices, heavy inventory, and the still distant April deadline for buyer credits. New home sales fell to a much lower-than-expected annual rate of 309,000 in January."The housing credit, extended for first time home buyers had minimal to no effect on housing starts and prices. The median home price fell 5.6% in January, down to $203,500. Inventory jumped to 9.1 months, which erased 8 months of incremental improvement. Not good news generally. As home prices continue to fall, it will be more difficult going forward, for families to repair their personal balance sheets, as the value of equity in their homes will continue to deteriorate. This will have an adverse affect on consumer spending which is the largest component of GDP. Home prices falling will continue to lead directly toward depressed output levels.

families trying to repair personal balance sheets will be more difficult

Tuesday, February 23, 2010

Consumer Confidence "Unexpectedly Falls"

"The economy “may not be out of the woods,” said Steven Ricchiuto, chief economist at Mizuho Securities USA Inc. in New York. Most of the deterioration “is labor market related. Consumer spending is going to disappoint throughout most of the year,” he said."I don't know for sure whether I agree or disagree. The market just feels stagnant right now. There's been very little movement on the jobs front in either direction, but in general we have a manufacturing and retail sector that seem to be heating up. In particular, the consumer retail space added 42,000 jobs last month which makes me inclined to think business feels better about recovery. But with Consumer Confidence so low its hard to believe those gains in employment will be sustainable.

So a quick rundown. Last week PPI was up, core CPI was down, and now Consumer Confidence is down. This looks like a recipe for narrowing profit margins as input prices rise and consumers fail to bare the burden of the increase. Today, stocks are down accordingly for all major indexes and treasuries are up. The company I'm doing for my investment group report announces earnings today, bad news for me, it's high end retail... We'll see if the "bottom up" approach to investing advocated in the group helps me out here. From a valuation standpoint, the stock looks good, but my common sense is telling me otherwise right now. Oh well, if we ever do recover high in retail will more than likely help lead the way out. Nordstrom is up 100% in the last 10 months, good call for my updown.com portfolio.

Friday, February 19, 2010

CPI Release

Thursday, February 18, 2010

Death Spiral in Health Insurance

Dr. Krugman gets it right on this issue again. I'd really like to get something done on health care. 39% increase in premiums? You can't expect healthy people to keep paying if cost trends of that nature continue, which appears very likely, as healthy people have an incentive to get out of the "risk pool," making said pool even less healthy, and raising premiums even more. Here's a link to the full article, a pretty good read, but the gist of it is posted above."Here’s the story: About 800,000 people in California who buy insurance on the individual market — as opposed to getting it through their employers — are covered by Anthem Blue Cross, a WellPoint subsidiary. These are the people who were recently told to expect dramatic rate increases, in some cases as high as 39 percent.

Why the huge increase? It’s not profiteering, says WellPoint, which claims instead (without using the term) that it’s facing a classic insurance death spiral.

Bear in mind that private health insurance only works if insurers can sell policies to both sick and healthy customers. If too many healthy people decide that they’d rather take their chances and remain uninsured, the risk pool deteriorates, forcing insurers to raise premiums. This, in turn, leads more healthy people to drop coverage, worsening the risk pool even further, and so on."

PPI Release

Or I guess one chart, since the other won't post currently... I'll work on getting it up in the morning.

Or I guess one chart, since the other won't post currently... I'll work on getting it up in the morning. Hooray! Two charts!

Hooray! Two charts!

Weekly Unemployment Claims

From Calculated Risk:

"The four-week average of weekly unemployment claims decreased this week by 1,500 to 467,500.More not so good news on the jobs front. I'm starting to grow impatient, at some point we're going to need to see this turn around. The trend is very worrisome considering the government stimulus money has already had its biggest affect and interest rates will likely rise as the Fed ends its purchases of mortgage backed securities. Combine this with the stronger dollar, which obviously won't help export markets, and you have a recipe for more stagnant job numbers. Sad...

The current level of 473,000 (and 4-week average of 467,500) are very high and suggest continuing job losses in February."

Fed Raises the Discount Rate

Wednesday, February 17, 2010

"Inflation: Mind The Gap" - Response

The idea here is that "slack" in the economy, which plays a big role in Federal Reserve monetary policy, is a good predictor of inflation risk. When the unemployment gap is large, that is, the difference between potential (NAIRU) and actual unemployment is large, there is sufficient slack in the economy such that inflation risks are low, and that disinflation is more likely. The implications of this model would suggest the Federal Reserve maintain a low federal funds rate for an extended period, as is current policy. The unemployment rate is projected to decline marginally over the next two years, never reaching NAIRU. This suggests that we're due for an extended period of disinflation, all else equal. We'll see later in the week what the CPI numbers suggest.

I'm not entirely convinced of this relationship based on the model alone. I understand that as long as there is an excess supply of labor, and few job openings, that wages will remain depressed. But I'm not sure that wages are the primary driver of price inflation. It seems that under normal circumstances, higher demand will lead to higher input prices, higher final good prices, and then higher wages. I guess the difference here is that potential price increases cannot lead to wage increases because of the excess labor supply and that consumers can't drive prices higher without a higher wage. I understand the logic, but for some reason it seems counter intuitive to me that increasing demand won't lead to price increases.

I feel like inventory consolidation has a lot to do with the story. When inventories are restored to normal levels, and capacity utilization remains low, its as if we've just come down to a lower "potential" level of output. Unless something changes dramatically we're not going to see an accelerated return to the previous trend. My thinking here is basically that NAIRU might get adjusted upward at some point, giving the model a little less slack, and therefore a little more potential for inflation. If the model is correct, it looks like we're headed for an extended period of disinflation and quite possibly deflation. It wouldn't surprise me to see this trend develop in the short term, but over the entire period of unemployment above NAIRU I can't imagine we're going to see extended deflation.

Mixed Signals

In other news, industrial production increased .9%, growth was strong across the entire sector, particularly in the auto-industry, where motor vehicles and parts were up 4.9% in January after receding .3% December.

With an exception for the activity in building permits, housing and industrial production had good months in January. We'll see if anything translates over to higher employment numbers when the jobless claims come out tomorrow. The one concerning piece of news I saw come out today was from the import and export price report.

"Import prices jumped 1.4 percent in January, driven by a 4.8 percent surge in the price of petroleum imports but also showing a 0.6 percent rise excluding petroleum. . . . . Export prices, up 0.8 percent, rose for a third straight month. Agricultural prices show pressure, up 1.4 percent, as do industrial supplies, up 1.9 percent."Most of the growth in prices was due to inputs, raw materials and such, rather than in final goods, implying that producers are sheltering most of the burden for increased prices. Tomorrow the producer price index (PPI) will be released and on Friday we'll see the consumber price index (CPI). My guess is that we might see larger increases in the PPI than in the CPI. In other words, consumer demand still might not be able to carry the burden of higher prices. We'll see in the next few days.

Tuesday, February 16, 2010

Housing Market Index

"The housing market index rose 2 points in February to a higher-than-expected but still very depressed level of 17. The consensus forecast was looking for a dip to 14."I guess an uptick is better than a down tick, but from where we are right now, there's really nowhere left to go. The report mentions that single family home sales were up slightly and that builders seem more optimistic about improving market conditions. I guess this is some good news, the rest of the broader economic outlook is improving as well. Consumer sentiment has developed a slight upward trend, the manufacturing sector is still churning along nicely, we've seen increased activity in retail and what looks like a bottom (from a data standpoint) in the unemployment numbers.

At this particular juncture its difficult to make an argument against, at least some short term economic recovery. We're still yet to see how markets will be affected when stimulus spending slows down and the Fed stops purchasing agency debt and mortgage backed securities. Some estimates out there today estimate treasuries jumping anywhere from 100 to 200 basis points. I don't know if I see an increase of quite that magnitude in the future, but there will be an increase no doubt. Higher rates will clamp down on what little recovery we've had in housing and put more pressure on the financial system. This, in combination with stimulus measures for new home tax credits halting in April will have a further adverse affect on housing. I've said this hundreds of times, but I'm still looking for jobs, and they don't really seem to be out there. Most estimates still assume an unemployment rate of near 10% through 2010 with improvements coming in the latter half of the year. This recovery will likely be a slow one, and hopefully the economy can stand on its own without fiscal and monetary government assistance.

That's all for now, I'm going to grab some breakfast.

Saturday, February 13, 2010

Monetary Unions

"Spain is an object lesson in the problems of having monetary union without fiscal and labor market integration. First, there was a huge boom in Spain, largely driven by a housing bubble — and financed by capital outflows from Germany. This boom pulled up Spanish wages. Then the bubble burst, leaving Spanish labor overpriced relative to Germany and France, and precipitating a surge in unemployment. It also led to large Spanish budget deficits, mainly because of collapsing revenue but also due to efforts to limit the rise in unemployment.Krugman has more of the same here... He mentions that even skeptics of the euro monetary union didn't foresee problems being this bad, which makes some sense. Nobody thought we were going to have exogenous shocks in the housing markets to quite the extent that we did. But given the shocks, the outcomes in Europe certainly aren't surprising. Spain is paralyzed at the moment, (as a Greece and Ireland, but for slightly different reasons,) almost powerless to do anything to keep themselves from falling into a deflationary spiral, which, as it is, represents the only way to bring them back to some kind of equilibrium with the rest of the EU.If Spain had its own currency, this would be a good time to devalue; but it doesn’t.

On the other hand, if Spain were like Florida, its problems wouldn’t be as severe. The budget deficit wouldn’t be as large, because social insurance payments would be coming from Brussels, just as Social Security and Medicare come from Washington. And there would be a safety valve for unemployment, as many workers would migrate to regions with better prospects."

Friday, February 12, 2010

Krugman Gone Wild

"President Barack Obama said he doesn’t “begrudge” the $17 million bonus awarded to JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon or the $9 million issued to Goldman Sachs Group Inc. CEO Lloyd Blankfein, noting that some athletes take home more pay.Krugman responds:

Generally, I'm a Krugman fan, but this threw me way off base. "We're doomed?" You can't be serious Paul. I've complained in the past, (privately and amongst friends) about right wing media outlets and congressmen misrepresenting actual facts, but I expected better from Dr. Krugman. Bonuses paid to Wall Street executives did not cost American families their homes, they did not bring the world economy to the brink of collapse. This rhetoric from the left side is just as bad as the rhetoric from the right side."Oh. My. God.

First of all, to my knowledge, irresponsible behavior by baseball players hasn’t brought the world economy to the brink of collapse and cost millions of innocent Americans their jobs and/or houses. . . . . .

The point is that these bank executives are not free agents who are earning big bucks in fair competition; they run companies that are essentially wards of the state. There’s good reason to feel outraged at the growing appearance that we’re running a system of lemon socialism, in which losses are public but gains are private. And at the very least, you would think that Obama would understand the importance of acknowledging public anger over what’s happening.

But no. If the Bloomberg story is to be believed, Obama thinks his key to electoral success is to trumpet 'the influence corporate leaders have had on his economic policies.'

We’re doomed."

Why should Obama care about a combined $26 million in bonuses paid out to a couple of Wall Street's more successful executives? Goldman paid back all of their TARP money long ago, and likely didn't even need their original $10 billion as they had $40 billion in cash at the time of the crisis. JP Morgan was responsible for a substantial privatized bail out of Washington Mutual, which had it gone under, would have actually cost Americans their jobs and homes. I suppose his implied argument has something to do with allowing the "culture of Wall Street," to perpetuate itself, and I agree to some extent. We need substantial financial reform, but regulating bonuses from the top down will have little to zero effect on the problem. Obama is hardly "trumpeting corporate influence," he's just being reasonable.

Usually Krugman is thoughtful in his articles and blog posts. Usually he tries to throw out ideas to promote healthy discussion that lead to solving problems. But in this case, he oversimplified an extremely complex issue in an attempt to get a reaction from people. Well, here's my reaction. I don't like it Paul. Your readers aren't the ultra-right conservative base. You can't go Fox news on us and not get called on it. That's my two-cents.

Thursday, February 11, 2010

Reeling It In

"Bernanke yesterday described how the Fed might use tools such as interest it pays on banks’ deposits to tighten credit “at some point.” In congressional testimony, he said a potential increase in the Fed’s discount rate would be part of the “normalization” of lending “before long” and wouldn’t signal a change in the outlook for monetary policy"The markets didn't really like the idea of rate hikes. Stocks fell intraday and treasuries fell, causing yields to increase. Personally knowing the Fed has an exit strategy is actually reassuring to me, I'm not sure why it adversely affected the broad equity indexes. Mark Thoma provides some excellent analysis here in a video . He makes one assertion in the model that's no necessarily correct but it only matters in extreme circumstances. Banks don't always buy from the fed at the line "id," they didn't in fact at the beginning of the crisis because banks were worried about showing weakness. So there are circumstances where banks will pay a higher rate than the discount rate.

Friday, February 5, 2010

Efficient Markets Hypothesis?

I discovered something very interesting about the way stocks are valued and the way finance works when I did my analysis of Rockwell Automation for the investment group here at UO. I was working on my comparables analysis, using trailing twelve month data, and a colleague of mine told me I should use forward looking analyst estimates because "they're probably more accurate than past data going forward." This notion really baffled me, and I had to admit, he had a fair argument. Future estimates could very well shed more light on a companies future, than past data, (next time maybe I'll run a little AR(1) model and see for myself). But at the same time I was skeptical, past data is 100% accurate, it 100% reflects the results of the managerial decisions made within an economic environment over some time period. How could simple projections possibly be more useful? My conclusion... They're not.

Let's talk facts. A couple of weeks ago the S&P 500 was trading at over 25 times earnings, its highest level since 2002, (if that doesn't scream overvaluation I don't know what does.) Housing starts were declining, new home sales were declining, apartment vacancy rates were near historic highs, as were malls, offices etc. . . jobs unexpectedly decreased in December by a (now adjusted) 150,000, capacity utilization was high, exports were low, hiring expectations were low, and treasury yields were shrinking rapidly. There were very few positive broad economic indicators. The outlook in general looked fairly bleak. I didn't understand how day in and day out the market continued ticking upward in the face of all the poor data surrounding it. Here's what I've realized. First, Wall Street likes profits. The stock market doesn't care about economic conditions. I've noted in previous posts that profits have largely been driven by increases in labor productivity and lower costs as opposed to top line demand. This allows Wall Street analysts to price in higher earnings, and thus a higher stock price . Second, Wall street also likes pricing in information as early as possible, many times, before the information even becomes reality.

And here's where I get back to my discussion with my UOIG pal, and here's why we were due for a correction. The stock markets had priced in earnings based on analyst expectations that never really materialized. And if you look at the actual data, the result was not surprising. I was calling for a correction in early January. The pace of market acceleration was just not in line with macroeconomic reality. In plainer words, Wall Street got ahead of the recovery, and we're still not even sure we're in a real recovery. You could almost think of it as a little mini bubble, which brings me to the title of this post. Efficient markets just don't exist. Even when given access to perfect information, people still act irrationally. It's not their fault, they're just trying to make an honest living, but it might be easier if they paid more attention to real fundamentals, and less attention to projected earnings.

Unemployment Numbers

Top story here is a lower unemployment rate, down to 9.7% in January from a December level of 10%. Non-farm payrolls declined by 20,000, a somewhat negligible decline. All in all, jobs were relatively flat in January excluding a few positive signs in the report.

I've posted several times recently about the broad uptick in most manufacturing indexes and whether or not it represents only an inventory bounce, or significant demand side economic growth. Industrial production, ISM PMI, and capacity utilization have all been improving at an accelerated pace in recent months. Until now, none of it had translated into any good news on the jobs front, (in December manufacturing still lost 27,000 jobs), but finally, for the month of January we have a positive jobs number in the manufacturing sector to the tune of 11,000 new jobs. This still isn't exactly the pace of growth we'd like to see, but it's certainly better than nothing. Continuing increases in labor productivity and average hours worked per week have given manufacturers further incentive to stand pat rather than hire more workers. From a business perspective, if your employees are working hard, producing well, and on average not working overtime, there's no reason to seek out and hire new workers. Your margins are increasing because labor productivity growth is far outpacing wage growth, which leads to higher profits. Couple the prospects of lower labor costs with uncertainty in the economy and you have a perfect environment for slow job growth in manufacturing."Employment in manufacturing was little changed in January (11,000). After

experiencing steep job losses earlier in the recession, employment declines

moderated considerably in the second half of 2009.

Retail trade employment rose by 42,000 in January, after showing little

change in the prior 2 months. Job gains occurred in January among food stores

(14,000), clothing stores (13,000), and general merchandise retailers (10,000)."

The retail story is very similar but we're actually starting to see significant job creation here. Firms have seen increases in consumer sentiment and PCE translate to higher sales, and are hiring accordingly. We seem to be recovering, slightly, in at least one or two sectors. This is some good news, but below is something to temper your enthusiasm a little.

So this isn't really surprising given commercial real estate markets recently, check out this post from a few weeks ago for further analysis of the commercial mortgage backed security (CMBS) market. Anyway, it appears construction in residential and non-residential will be lagging the recovery, which will result in more numbers like the one above. Sad but true."Construction employment declined by 75,000 in January, with nonresidential

specialty trade contractors (-48,000) accounting for the majority of the de-

cline. Since December 2007, employment in construction has fallen by 1.9

million."

Thursday, February 4, 2010

The "You Can't Seriously Be This Stupid" Game

From Hennessey:

"Argument (Obama): The previous administration and previous Congresses created an expensive new drug program (Medicare)… without paying for any of it.My response: The administration has made proposals to limit the costs of medicare long term. But Hennessey and others in the republican party have spun what would be a fiscally responsible policy as, "destroying medicare," and "pulling the tube on grandma." There are proposals on the table right now, from republican members of the budget committee, that would serve to limit future costs of Medicare. From the GOP Issues Conference:

Response: This Medicare drug program is ongoing. If the President thinks it is too expensive, then he should propose to make it less expensive. If instead he thinks it should be paid for, then he should propose other spending cuts or tax increases to offset the future costs." . . . etc.

"--THE PRESIDENT: . . .I want to make sure that I'm not being unfair to your proposal, but I just want to point out that I've read it. And the basic idea would be that at some point we hold Medicare cost per recipient constant as a way of making sure that that doesn't go way out of whack, and I'm sure there are some details thatSo here you have The President and Republican Congressman Ryan (on the budget committee) speaking together in a civil manner about reforming medicare, cutting costs, or "pulling the tube on grandma," if you will. There are three main things to take away here. 1. $38 trillion dollar unfunded liability. This is totally unsustainable going forward 2. Republicans acknowledge the need for reform proposals, as projected deficit growth is unsustainable. 3. The republican party simultaneously recognizes the need for reform, and then calls out the democratic party for proposals that they help develop. This is a problem, and it's happening because of people like Keith Hennessey.

--CONGRESSMAN RYAN (speaking to The President): We drew it as a blend of inflation and health inflation, the point of our plan is -- because Medicare, as you know, is a $38 trillion unfunded liability -- it has to be reform for younger generations because it won't exist because it's going bankrupt. . ."

--THE PRESIDENT: When we made a very modest proposal as part of our package, our health care reform package, to eliminate the subsidies going to insurance companies for Medicare Advantage, we were attacked across the board, by many on your aisle, for slashing Medicare. You remember?"

From Hennessey:

These are unsubstantiated claims. The Obama administration is currently scaling back operations in Iraq. Further, future war operations will be paid for in the form of higher taxes when the Bush tax cuts expire. The Iraq war, again, was total fallacy from the beginning. There is no connection between Osama Bin Laden and Saddam Hussein, and there were never any weapons of mass destruction. The giant gap created in the Budget was due to Bush policies, waging wars, and lowering taxes. Again, Hennessey is deliberately misguiding the public."Argument (Obama): The previous Administration and Congresses funded two wars without paying for it.

- Response 1: The Obama Administration is continuing these wars without paying for them, and expanding forces in Afghanistan without paying for that.

From Hennessey:

"Argument (Obama): The previous Administration cut taxes for the wealthy without paying for it.Fair point, sort of. Our long term debt problems lay in entitlement spending. Raising taxes will not lower spending. Raising taxes will likely only lead to more spending and bigger government, (a debate for another time.) I guess I just have a problem with what Keith is saying, and what his party has been doing. I commented above on how democratic and republican leadership both recognize the need for entitlement spending reform, i.e. health care reform. I just know that as soon as a policy is proposed, one that might really control medicare costs, you'll see immense republican opposition.

Response: Our medium-term and long-term deficit problems are driven by the growth of entitlement spending: Social Security, Medicare, and Medicaid. Raising taxes will not slow this spending, it will just buy us a few years of delay and slow economic growth."

From Hennessey:

What is he saying here exactly? That somehow $230 billion dollars of the 2001 budget deficit wasn't due to George Bush? Fine Keith, I'll give you that $230 billion. But Hennessey doesn't mention the fact that "economic and technical changes" were favorable in terms of the budget from 2002 to 2007. Somehow during that period the budget deficit skyrocketed, despite what Hennessey seems to declare is sound fiscal policy. I don't see how you can downplay the Bush administration arriving with a $200 billion dollar surplus, and leaving 8 years later, with a $1.3 trillion dollar deficit. You can manipulate the numbers all you want. You can say that the Congressional Budget Office, (an independent, bipartisan body) was somehow wrong, or somehow trying to make democrats look better. But you can't fake a $1.5 trillion swing in 8 years. There's no way to manipulate the bottom line here."Argument (Obama): The Bush policies caused a $200 B annual surplus and “projected surpluses stretching out toward the horizon” to turn into deficits.

Response: This argument always relies on one specific forecast which later turned out to be inaccurate. In January 2001 CBO projected a 2002 surplus of $313 B. One year later they projected a 2002 deficit of $21 B. Of the $334 B decline, CBO said 73% was from “economic and technical changes” beyond President Bush’s control. The other 27% was the result of legislation."

From Hennessey:

So now he results to conspiracy theories? That somehow an independent office, the CBO, manipulated things to work in Obama's favor? $8 trillion is "made up." This is completely ludicrous. The CBO doesn't have an incentive to do the Obama administration any favors."Argument: When President Obama took office, he faced projected deficits of $8 trillion over the next decade.

Response: There is no delicate way for me to say this. The $8 trillion number is made up. In January 2009 CBO projected deficits for the next decade of $3.1 trillion. The President’s first budget played games by redefining the baseline to make the starting point look as bad as possible so that Team Obama could claim their policies would reduce the deficit. Don’t get me wrong — $3.1 trillion of projected deficits is still a huge bad number. At the same time, $4.9 trillion is a lot of gaming."

Hennessey's "analysis," of The President's statement is completely ridiculous. Over and over again he stretches truths and carefully manipulates the facts to work in his favor. If one reads his entire piece one gets the impression that he advocates lower taxes and a shrinking deficit. I'm sorry to bring him into the real world, but it doesn't work that way. He hints at wanting to make changes to entitlement spending, by bringing up medicaid and medicare, but completely disregards the fact that controlling costs for such programs is politically unfeasible in the current environment. The democrats have tried, and were turned away by a radical and ignorant republican base. I'm not trying to say anything about republican politicians in general. I understand that they too hope for progress on such issues. But when pundits like Hennessey and others continually lie to the base, they back themselves into a corner politically, where it makes progress very difficult.

Tuesday, February 2, 2010

ISM Numbers Show Positive Signs

Some of the highlights, the ISM PMI (purchase managers index) increased from 54.9 to 58.4, (again, value over 50 suggests expansion, under 50 suggests contraction), showing accelerating strength in the manufacturing sector. I've talked about this a number of times and hate to beat a dead horse but... we'll see if this translates into any jobs. Given current hiring expectations going forward and increases in labor productivity, my guess is probably not. At some point this rise in manufacturing is going to slow considerably. In my opinion, the increasing strength in the sector looks to be the result of an inventory bounce, and not much more. I certainly hope I'm wrong.

The ISM exports number was flat at 46 from December and the imports index shrank substantially to 47. I'm not entirely sure why, perhaps because of higher import prices in recent months and stagnant demand. Inventories contracted as well, consistent with the Q4 GDP report.

In my opinion, none of these numbers mean much until we start seeing positive changes on the jobs front, and I'm not sure that's going to happen. We'll find out later in the week.

Why Not Tax Excess Reserves?

"From a macroeconomic standpoint, short-run deficit reduction is contractionary. Reducing the budget deficit toward manageable levels is necessary from a federal fiscal standpoint, but it reduces short-term economic growth. This is the Administration’s core short-term economic policy challenge, the tradeoff between fiscal stimulus and deficit reduction over the next 2-3 years."Now, in all honesty, I don't believe the increasing budget deficit poses any major short term problems. The world reserve currency is still the U.S. dollar, (though declining slightly in popularity,) and our government debt remains of the safest assets to hold in the world. But in any case, politics plays a significant role in policy. If republicans are truly populist, and are opposed to higher taxes on individuals, and if they are truly fiscally conservative and would like to see deficit reductions ahead of government stimulus. Then what about taxing excess bank reserves? There's literally $1 trillion+ out there, doing absolutely nothing. See the graph below:

It's a politically feasible source of revenue. Americans are furious with Wall Street and the banks, so why not tax the banks their "bailout money,?" I'm aware excess reserves do not necessarily coincide bailout money, but the average American certainly isn't, (yeah that was a little dig at the republican constituency.) It would narrow the deficit, and it might provide banks with an incentive to start lending.

There are a couple of logical reasons as to why banks aren't lending. Currently, banks are probably holding onto excess reserves as a hedge against the Fed unwinding its emergency lending facilities. They also recognize that at some point, inflation might pose a greater risk than it does today, and the money supply will have to contract. When that happens, the Fed will sell treasuries to reign in some of that excess and banks will have to pay up. Most importantly, there just aren't many opportunities out there. The money is in the system with no place to go. Households are busy saving/repairing their balance sheets and have no incentive to take on more debt. Luckily, I have a solution...

While the average American can't find any money to spend, and won't want to take on the risk associated with borrowing, there's someone who can. A tax on excess reserves would help put to use some of those stagnant excess funds. The federal government could use the revenue to help create more jobs etc... all the while narrowing the deficit. So when Hennessey talks about the "balance" between employment and deficit reduction, this proposal could in theory, present a solution.

I realize there are plenty of holes in this idea, but I'm an undergrad student. I know it might not be "fair," to tax all banks holding excess reserves, especially in the aftermath of the financial meltdown. I realize that many banks are only acting responsibly by holding reserves, and I talked about the incentive structure for that above. I realize that punishing them with a tax for acting responsibly isn't necessarily just. But lets be honest. Banks have had plenty of help from America in recent months. It might be time they return the favor.

Friday, January 29, 2010

I Have to Post Something About GDP

"Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis."I'm excited about that 5.7%, I really am, but knowing that GDP growth due to real final demand was only 2.2% still has me a bit bearish on the market. Later in the BEA report you find:

"Real final sales of domestic product -- GDP less change in private inventories -- increased 2.2 percent in the fourth quarter, compared with an increase of 1.5 percent in the third."So more than half of the 5.7% Q4 GDP growth is due to "change in private inventories." It's what economists have been talking about for quite some time. The increases in ISM PMI, capacity utilization, industrial production, etc. . . for the moment anyway, are mainly the result of an inventory bounce. That's why you've seen increases in these broad indexes without seeing any job creation, (and without the expectation of any job creation.) Firms clearly don't expect growth this high going forward, else they'd be hiring, but they're not. Last month the manufacturing sector lost 27,000 more jobs.

I'll highlight a couple of other things I found relatively interesting. Personal Consumption Expenditures (PCE) and Residential Investment (RI) are both growing, but at a slower pace than they were in Q3. This doesn't bode well for a quick recovery, which shouldn't be a surprise at this point. Calculated Risk has more:

"It is not a surprise that both key leading sectors are struggling. The personal saving rate increased slightly to 4.6% in Q4, and I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.Can't help but agree with the analysis in housing. There has been literally NO good news coming out of that sector in recent weeks. Home starts are down, months of supply is up, new home sales are down, existing home sales are down. Nothing looks particularly good here.

And there is no reason to expect a sustained increase in RI until the excess housing inventory is absorbed. In fact, based on recent reports of housing starts and new home sales, there is a good chance that residential investment will be a slight drag on GDP in Q1 2010."

Check out this post on Calculated Risk for a more detailed overview of the Q4 GDP report.

Thursday, January 28, 2010

Postive Durables, Negative Jobs

"Orders for capital goods rose in December, and more Americans than anticipated filed claims for unemployment benefits last week, indicating business investment is making a comeback while the job market stagnates."

State of the Union Address

I think the speech he gave was nearly perfect. He addressed almost every issue, and did it well. He even paid tribute to Ronald Reagan by blaming America's current situation on the Carter, cough... Bush administration:

"At the beginning of the last decade, the year 2000, America had a budget surplus of over $200 billion. (Applause.) By the time I took office, we had a one-year deficit of over $1 trillion and projected deficits of $8 trillion over the next decade. Most of this was the result of not paying for two wars, two tax cuts, and an expensive prescription drug program. On top of that, the effects of the recession put a $3 trillion hole in our budget. All this was before I walked in the door."Believe or not, I think this was an important step. Much of Obama's decline in popularity is likely attributable to people forgetting the above facts. Politically, its important to remind people how we got here, and to not stand by idly as opponents rewrite history such that it better reflects on their own failed policies.

About health care:

"So, as temperatures cool, I want everyone to take another look at the plan we've proposed. There's a reason why many doctors, nurses, and health care experts who know our system best consider this approach a vast improvement over the status quo. But if anyone from either party has a better approach that will bring down premiums, bring down the deficit, cover the uninsured, strengthen Medicare for seniors, and stop insurance company abuses, let me know.About the Supreme Court:

Here's what I ask Congress, though: Don't walk away from reform. Not now. Not when we are so close. Let us find a way to come together and finish the job for the American people. (Applause.)"

"With all due deference to separation of powers, last week the Supreme Court reversed a century of law that I believe will open the floodgates for special interests -- including foreign corporations -- to spend without limit in our elections. (Applause.) I don't think American elections should be bankrolled by America's most powerful interests, or worse, by foreign entities. (Applause.) They should be decided by the American people. And I'd urge Democrats and Republicans to pass a bill that helps to correct some of these problems."About the filibuster:

"To Democrats, I would remind you that we still have the largest majority in decades, and the people expect us to solve problems, not run for the hills. (Applause.) And if the Republican leadership is going to insist that 60 votes in the Senate are required to do any business at all in this town -- a supermajority -- then the responsibility to govern is now yours as well. (Applause.) Just saying no to everything may be good short-term politics, but it's not leadership. We were sent here to serve our citizens, not our ambitions. (Applause.) So let's show the American people that we can do it together. (Applause.)"In general, I thought it was an excellent speech. Though I'm still not necessarily a fan of the "spending freeze." It might be good politics, (this remains unseen), but its certainly not good policy. While the American people might appreciate the Federal government symbolically "tightening its belt," Brad DeLong and others sure don't:

"But in 2011 GDP will be lower by $35 billion--employment lower by 350,000 or so--and in 2012 GDP will be lower by $70 billion--employment lower by 700,000 or so--than it would have been had non-defense discretionary grown at its normal rate."If you want my reaction to the policy, check this previous blog post.

And one last thing. Is this really feasible...?

"Third, we need to export more of our goods. (Applause.) Because the more products we make and sell to other countries, the more jobs we support right here in America. (Applause.) So tonight, we set a new goal: We will double our exports over the next five years, an increase that will support two million jobs in America. (Applause.) To help meet this goal, we're launching a National Export Initiative that will help farmers and small businesses increase their exports, and reform export controls consistent with national security. (Applause.)"My first inclination is no, so I checked out the data:

Exports would have to increase by 1.6 trillion over a 5 year period in order to "double." The trend appears to be more exponential than linear, and the last double only took about 8 1/2 years, (2001-2009). The increase in free trade and overall globalization could explain the exponential trend. If that trend continues, doubling exports in a five year time frame might be entirely possible. Maybe this new "export initiative," will have some legs. However, if exports increase at the 01-09 rate, it will take nearly 12 years to double. I'll continue to be a naysayer here. I don't think this is going to happen, but the trend in the data gives me some hope. Still, kind of interesting that Obama is going Mercantilist on us right now. Paul Krugman and others have been pretty disappointed with regards to the spending freeze, but moving toward a positive balance of trade might make them happy.

Exports would have to increase by 1.6 trillion over a 5 year period in order to "double." The trend appears to be more exponential than linear, and the last double only took about 8 1/2 years, (2001-2009). The increase in free trade and overall globalization could explain the exponential trend. If that trend continues, doubling exports in a five year time frame might be entirely possible. Maybe this new "export initiative," will have some legs. However, if exports increase at the 01-09 rate, it will take nearly 12 years to double. I'll continue to be a naysayer here. I don't think this is going to happen, but the trend in the data gives me some hope. Still, kind of interesting that Obama is going Mercantilist on us right now. Paul Krugman and others have been pretty disappointed with regards to the spending freeze, but moving toward a positive balance of trade might make them happy.

Wednesday, January 27, 2010

More Data on Housing

"The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 342 thousand. This is a sharp decrease from the revised rate of 370 thousand in November (revised from 355 thousand)."More bad news in housing, probably why the Fed failed to include language in the FOMC statement about a "housing recovery." The housing market currently holds roughly an 8.1 months supply, which is well below the all times high of 12.4 months, but still considerably greater than the average of around 6 months. In December a record low 23,000 new homes were sold. With foreclosures rising, home sales continuing to fall, and prices stagnating, an end to the country's housing woes might not come for quite some time.

FOMC Statement

Nothing new here really. Calculated Risk pointed out that the language regarding a recovery in the housing sector has been removed. November and December statements made notes of the pickup in housing starts which have subsequently declined. The Fed continues to believe that economic conditions warrant an exceptionally low level of the fed funds rate for an "extended period." The only change is a "no" vote, from Thomas Hoenig, who for some reason believes there's some imminent threat of inflation. His concerns are, in my opinion, unfounded and delusional, but I've talked about that recently.

Obama's Spending Freeze

"President Obama will call for a three-year freeze in spending on many domestic programs, and for increases no greater than inflation after that, an initiative intended to signal his seriousness about cutting the budget deficit, administration officials said Monday."Is anyone else as unimpressed by this as I am? Brad Delong, Paul Krugman, and Mark Thoma to name a few. The "spending freeze" will stop growth of government discretionary spending through 2013, and will only allow for growth proportional to inflation after that. We're talking about $250 billion in savings over 10 years, compare that with the $9 trillion dollars or so the deficit is forecast to rise during that time and. . . I'm unimpressed. Administration officials contend that the spending freeze on the smaller, discretionary part of the budget will have symbolic value. In other words, the spending freeze is more of a political ploy to gain populist support than anything else.

But I feel the administration is misreading what the public is looking for. They don't want a political ploy disguised under the sheath of budget responsibility. They want some real action. They want unemployment numbers to come down. They're looking for a revival in the job markets. A spending freeze is the exact opposite of what needs to be done to lower unemployment. It shows a growing disconnect between the White House and the American public. I've been a strong Obama supporter for a while, but his wavering stance on health care, and now this, has got me rethinking the situation.

One more note on this issue... If the administration really wanted to do something about the budget deficit, they might want to think about real health care reform...

"It is the growth in the so-called entitlement programs — Medicare, Medicaid and Social Security — that is the major factor behind projections of unsustainably high deficits, because of rapidly rising health costs and an aging population." -NY TimesThat is all.

Monday, January 25, 2010

Housing Starts Down, No Surprise

"Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR)."The 16.7% decrease month to month looks alarming at first but again, the first time home buyers tax incentive expired in November. Essentially, tax credits of this nature borrow demand from the future. People rush to buy houses before the credit expires in order to take advantage of the financial incentive. The Obama Administration recently announced another first time buyer credit, this time extended to include current homeowners. It likely won't be as effective this time around for the above reason...

Friday, January 22, 2010

Time Running Out for Big Ben?

"Our next Federal Reserve chairman must represent a clean break from the failed policies of the past," Boxer said. "It is time for Main Street to have a champion at the Fed." -CNBC.comMain street meets Federal Reserve Chairman... What? I don't mean to sound elitist, but the GOP's definition of "main street" is kind of a turn off for me, especially when I think about "main street" conducting monetary policy. We don't need to replace our Ivy League educated officials with an everyday man from the bayou. Let's be honest, Bernanke was late to the party when it came to recognizing the financial crisis but since has done a pretty remarkable job. He at least deserves the right to see this thing through.

One thing most people haven't talked about here is central bank independence. I'd prefer our representatives not set the precedent of removing the Fed Chair every time unemployment ticks upward. Mixing politics with monetary policy is a dangerous game for a plethora of reasons that I won't delve into too much right now... Let's just say I'd rather not have congress be responsible, directly or indirectly, for maintaining a low inflation rate.

Supreme Blunder

"The political scientist Barbara Sinclair has done the math. In the 1960s, she finds, 'extended-debate-related problems' — threatened or actual filibusters — affected only 8 percent of major legislation. By the 1980s, that had risen to 27 percent. But after Democrats retook control of Congress in 2006 and Republicans found themselves in the minority, it soared to 70 percent."And if you want a visual representation check out this chart:

It's clearly getting out of hand... Maybe part of it is these, "extraordinary times," but I'm just not buying it. When the republican minority attempts to filibuster a military spending bill, considering their collective stance on the issue just a year ago, something is wrong. The only republican agenda at this point is blocking progress, regardless of the issue.

Unfortunately, the problems we're already experiencing, (corporate lobbyists controlling Washington and blocking reform), are about to get much, much worse. A lobbyist can now literally tell a politician "you're either with us, or against us, and if you're against us, we will spend unlimited dollars to make sure you don't have a job next term." The Supreme Court has given corporate America the go ahead to buy votes. This might be the most irresponsible decision I've seen the GOP make since anointing Sarah Palin, which is why I guess I shouldn't be all that surprised.

China's Growing Inflation Woes

"Inflation accelerated to a more-than-forecast 1.9 percent in December and gross domestic product climbed 10.7 percent, the National Bureau of Statistics said in Beijing yesterday"This is after a $586 billion stimulus package designed to help consumer purchases. With rising growth, inflation can become a potential risk. A fourth quarter survey of 50 Chinese cities showed that 46.8% of consumers said prices were "too high to accept." The response by Chinese government officials has been predictable. They're talking about raising interest rates and required reserve rates in order to trim the money supply and control liquidity. This policy may also have a minimal affect on Chinese GDP going forward. The spillover of this affect could be more significant abroad than it is in China because, as of now, the world is relying on Chinese growth to help it recover from a global recession. The good news is there's been talk of a possible appreciation of the yuan, a mild 3%, but something is better than nothing at this point. Any appreciation of the yuan will help international competitiveness and fuel international growth.

Regional Unemployment

"In December, 43 states and the District of Columbia recorded over-the-month unemployment rate increases, 4 states registered decreases, and 3 states had no change."and there's the story below:

"Real average hourly earnings fell 1.3 pNothing new really, just a few more reasons to be weary of joblessness during the "recovery."ercent, seasonally adjusted, from December 2008 to December 2009. A 0.3-percent decline in average weekly hours combined with the decrease in real average hourly earnings resulted in a 1.6-percent decrease in real average weekly earnings during this period."

Thursday, January 21, 2010

Big Bank Limit Proposals

"The plans - the most far-reaching yet -include limits to the size of banks and restrictions on riskier trading. . . His proposals also include a ban on retail banks from using their own money in investments - known as proprietary trading. Instead, banks would be limited to investing their customers' funds."In my opinion, this is going overboard. I think some fine-tuning to the system would be more productive than tearing it down with a sledge-hammer. Think of it like a modern day surgeon vs. an 1700's pharmacist. You can either directly fix the problem, or you can let blood and cut off limbs. I guess Barack and Volcker want blood.

I saw the financial system collapse. I understand, for the most part, the main factors that contributed to its demise. But I'm just not buying that the system is totally "broken," so much so that we need to revert back to a Glass-Steagall type regulatory policy. I think future regulation should seek to create a better framework within the current system. America's new understanding (and believe me, many understand all too well,) that real estate investments won't lead to outrageous financial return, and in fact that both commercial and residential property can decrease in value, has put things in perspective. The chance of another speculative credit fueled asset price bubble occurring again in the near future is minuscule.

Hindsight is 20/20. "Risky" bank activity in 2006 was not considered risky at the time. But now conventional wisdom says otherwise. With the information we have today, firms are simply less likely to participate in said "risky" activities. Especially when the credit ratings of sub-prime mortgage backed securities accurately reflect their true risk, (i.e. no more AAA credit ratings please) . The free-market system works fantastically when people have perfect information. And to guard against future housing bubbles and the like, maybe we should regulate at the foundation, where the problems actually start. Minimum credit scores for potential home buyers? Minimum down payments on mortgages maybe? I feel like doing either of those two things would severely limit the potential for systemic risk.

Sadly, we live on a political canvas right now, where putting restrictions on the public just isn't politically feasible. Imagine if Obama told the American people, "to be approved for a mortgage, you must have a reasonable possibility of paying off that mortgage. . ." The gall of such a man! Should Americans really have to pay for the things they purchase? Politically, the answer is no, which is why we have a problem, and why we get garbage regulation proposals like the one out today.

Nobel Prize Winners Watch South Park?

Wednesday, January 20, 2010

Permits and Housing

"Building permits in the U.S. unexpectedly jumped in December, signaling gains in housing will be sustained into 2010 after winter weather depressed construction at the end of last year."Permits were up 10.9% in fact, pointing to future growth in housing starts. Also of interest,

Construction of single-family houses decreased 6.9 percent to a 456,000 rate, while permits increased 8.3 percent last month. Work on multifamily homes, such as townhouses and apartment buildings, climbed 12 percent to an annual rate of 101,000, a six-month high.Housing starts themselves were off 6.9%. Some experts point to the unusually cold weather of late as a reason for the decline. Maybe that has some merit. . . I don't know. The big news for me is the 12 percent climb in construction of multifamily homes. In my opinion, this signals the beginning of what might be a long term transition amongst American families from residential single family homes, to apartments and townhouses. The average consumer may have figured out that he/she can't afford a free standing home and must look elsewhere for housing opportunities. If multifamily homes continue growing at this rate, it might add yet another headwind to the recovery in housing. With high unemployment and rising home inventories, builders are already weary of undertaking new projects, this adds just one more thing for them to worry about. On the other hand, the increase in permits is definitely not something to be ignored, and displays if nothing else that conditions likely won't deteriorate further, at least in the near future, which can and should be interpreted as good news.

U.S. Stocks Fall

"I'm concerned we might have a mild short-term correction," said Bruce Bittles, chief investment strategist at Milwaukee-based Robert W. Baird & Co. . . "Market optimism looks excessive, people are optimistic about fourth-quarter earnings which really haven't materialized. All of that complacency isn't good."Not to toot my own horn or anything... But the fundamentals were telling us we needed a correction and I talked about it some in my week 1 posts, (which aren't actually on the blog because I didn't have a laptop at the time). Ready for some more fundamentals? The S&P 500 is valued at 25 times its companies' profits, which is the highest level since 2002. I'll be reflecting on what that means for a while...

Friday, January 15, 2010

Quick Notes on Today's News

From the Fed via Calculated Risk:

"Industrial production increased 0.6 percent in December. The gain primarily resulted from an increase of 5.9 percent in electric and gas utilities due to unseasonably cold weather. Manufacturing production edged down 0.1 percent, while the output of mines rose 0.2 percent. The change in the overall index was revised up in October, but it was revised down in November; for the fourth quarter as a whole, total industrial production increased at an annual rate of 7.0 percent. At 100.3 percent of its 2002 average, output in December was 2.0 percent below its year-earlier level. Capacity utilization for total industry edged up to 72.0 percent in December, a rate 8.9 percentage points below its average for the period from 1972 to 2008."I originally saw the 0.6 percent increase story on CNBC early this morning, (way too early in fact, my CNBC realtime app woke me up at 6:26AM), but no mention of unseasonably cold weather over there, at least not on the 6:20 version of the article, maybe its been updated since. Either way, an increase in industrial production is better than a decrease.

Also, the BLS released CPI and wage numbers today. The CPI was up .1%, hopefully alleviating some inflation worries. Real average hourly earnings were unchanged. Not a lot going on here other than more non-inflationary news. I'm going to have trouble calling this a real recovery until we get positive jobs information.

Taking Notes from my Professor... Fed Watch

I really liked point number 3 in your post, about retail activity. I used capacity utilization as one of my metrics in the project. So the chart you made about trends in retail sales was really interesting because it visually showed me how excess capacity develops, whether in consumer retail, or in manufacturing. I know we'd looked at similar charts in class, but we didn't explicitly make the connection to commercial real estate. The spread between the expected vs. actual trend makes a pretty compelling case for an excruciatingly slow recovery in commercial real estate. So when you say:

"Retail activity remains well below the trend expected in 2007. A forgotten piece of the puzzle, in my opinion."I can't help but agree. I hadn't made that connection previously but it makes perfect sense.

I also have a question and I'm hoping you might comment on it. You talked a little bit about the Chinese raising interest rates and how many (including myself,) logically concluded that it might lead to an eventual appreciation of the yuan, which would probably help U.S. balance of trade, which would likely help job growth. I don't necessarily live by Paul Krugman's "back of the hand" calculations, but he seems to think that an appreciation of the yuan could lead to significant job creation in the United States. Anyway, you say you're skeptical because:

"I can also see Chinese authorities attempt to use the external sector to compensate for waning domestic stimulus."I don't yet know enough about Chinese currency policy or the Chinese government. But could you explain to me what exactly you mean by the Chinese authorities using the "external sector" to compensate for "waning domestic stimulus." I guess I just don't follow the language?

Lastly, you talk about pent up demand in manufacturing and the inventory correction as being reasons for the V-shaped recovery in that sector, but you note that households remain "financially hobbled." So I did a little brainstorming and now I'm wondering about labor productivity numbers. I did a quick check on the BLS website and found this: "In manufacturing, productivity increased 13.4 percent while unit labor costs fell 6.1 percent." Here's a link to the Q3 report, it's over a month old but until the next one comes out, it's all I've got. A 13.4% increase in manufacturing labor productivity is probably not sustainable, but it does parallel December numbers in the ISM PMI, and capacity utilization. Given that, wouldn't we have expected December manufacturing employment to be up, rather than down 27,000? Manufacturing is clearly in, or is at least developing a trend representative of an expansion, so why aren't firms hiring? They can't keep meeting demand through productivity increases though that seems to be the goal right now. It seems manufacturers will have to start hiring in the near future, should they continue to see consistency in demand growth.

Your analysis, alluding to "pent up demand," as a cause for the accelerated growth in manufacturing makes me think that growth in the sector could possibly decelerate looking forward. As in, "pent up demand" has yielded a temporary positive shock. Also leading me to that conclusion is firms showing an unwillingness to hire. It's as though they're largely looking to avoid longer term labor costs as a hedge of sorts against the possibility of lower long term demand. It looks like a possible argument in favor of the "inventory bounce" theory, rather than an argument for a longer term trend toward recovery.

Let me know what you think if you have some time.

Thursday, January 14, 2010

Strong Dollar and Taxes

I suppose it's all consistent with his laissez-faire view of government, but still... In the last decade, neither Repulicans nor Democrats have proved they can spend responsibly. So in the world we live in, where spending is going to happen no matter what, it would seem raising taxes to balance the budget might help strengthen the dollar, which might make Larry a little happier.